FinOps: Optimizing Financial Infrastructure With DevOps

Understand how DevOps can inspire financial frameworks and models in any organization or community.

Finance is crucial in each and every segment of an organization. Be it academia or industry, there is always a need for financial backing and planning to execute a productive idea.

In recent days, there is a lot of talk about the FinTech sector, more popularly known through the blockchain, cryptocurrency and web3 buzzwords.

Before we proceed with this chapter, it is essential to understand that FinTech and FinOps are different. But the latter complements the other really well. FinOps can revolutionize the way FinTech works.

FinOps.org defines FinOps as:

FinOps is an evolving cloud financial management discipline and cultural practice that enables organizations to get maximum business value by helping engineering, finance, technology and business teams to collaborate on data-driven spending decisions.

I'm not a finance guy. But what I feel is, FinOps can be more than just empowering the cloud and data-driven decisions. Looking further outward from a universal perspective, FinOps is actually the application of DevOps inspired principles, coupled with effective DocOps and HumanOps strategies to maximize business value at minimal and optimized expenditure.

First, let us try to understand why any organization can incur losses. The most basic reasons are often found to be:

- Improper Financial planning

- Inefficient human co-ordination & workforce

- Inadequate documentation

- Unhealthy workplaces & human culture

Financial Planning

Before putting an idea into execution, preparing a feasibility report can be extremely crucial. A feasibility report allows an entrepreneur to envision the potential of their idea at a sandbox level. Good feasibility reports help minimize potential losses and maximize regular income.

Human co-ordination & workforce

It is always essential that all employees working in an organization have an uniform distribution of work roles effectively. Adequate workforce is also important to balance workloads amongst employees.

Adequate documentation

This relates to the feasibility report and every other documentation necessary to ensure the business plan goes through as planned. By using a careful DocOps strategy, you can rely on simple and effective documentation at every stage of business execution: before, after and current.

Healthy workplaces & human culture

Perhaps the most significant of all, a healthy workplace and culture plays a significant role in ensuring employees stay happy. The most effective way to make that sure is by using intelligently designed HumanOps strategies.

If you want to adopt a FinOps approach in your organization you can definitely follow the adoption steps as linked below.

But how can we look into it as development cycles? Isn't a financial decision also a continuously evolving process that undergoes continuous reviews as long as a project is live?

Taking inspiration from System Development Life Cycle (SDLC)

From a universal perspective, any financial infrastructure can be regarded as a system that undergoes continuous financial revisions during its development, based on project goals and requirements. Therefore, the System Development Life Cycle can certainly be adopted for optimized financial progress.

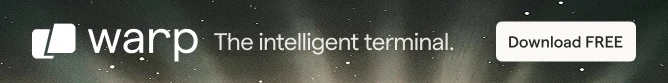

Investment Development Life Cycle (IDLC)

Investment Development Life Cycle is the fundamental motivation behind optimizing investments in any entrepreneurial project. Unless the sandbox model is not carefully and consistently monitored, any project would not be able to yield maximum profits in the long term.

A new project will always be under IDLC until it is ready to be embraced by the community as a promising piece of work that ensures a win-win scenario between the project owner and user. By community, I mean a synchronized collaboration amongst the project team and its clients/users.

IDLC is an essential financial methodology which consists of six essential stages. The development of investment in any project involves the following steps:

- Concept Plan: Collectively shaping a set of ideas into a source of income.

- Documentation & Feasibility Analysis: Use of effective DocOps strategies to analyze the feasibility of the potential project.

- Financial Investment: Initial Investment for sandbox level testing for income potential and also for actual project execution.

- Sandbox Execution: At this stage, the effectiveness of the project is tested only by the entrepreneurial team. Based on sandbox level observation, drawbacks are eliminated, and necessary improvements are made.

- Project Execution: The project is now agreed upon as client-ready and a self-sustainable financial model.

- Team Feedback: The team provides feedback on the project that is now live at a limited client level.

Until and unless it is established that the project is financially self-sustainable, this cycle will continue to exist. Once the project is ready - both client and community-wise, it no longer falls under IDLC. It eventually falls under an actual Financial Development Life Cycle (FDLC).

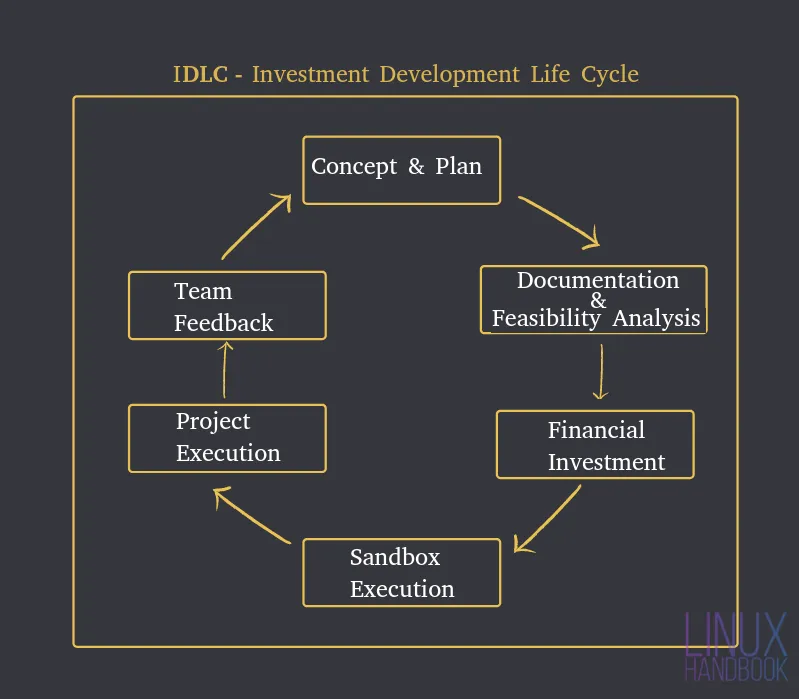

Financial Development Life Cycle

Financial Development Life Cycle is the fundamental motivation behind both the development and operation of a self-sustainable financial framework. It involves the continuous development of a project after its first inception and ensures its continuous improvement based on the feedback of founders, clients and the community.

- Concept Plan: Revisiting the set of ideas to further optimize the source of income.

- Documentation & Feasibility Analysis: This is when the financial model is further improved, especially based on community feedback. Feasibility is always re-assessed in this stage.

- Financial Investment: Based on revised feasibility and potential of the ongoing project, investments for sandbox level testing and actual project execution is reallocated to the core team.

- Sandbox Execution: The revised sandbox is retested for financial potential.

- Project Execution: The revised project is now agreed upon as client-ready and a further improved self-sustainable financial model.

- Team Feedback: At this stage, the project is now ready for the community as well, that is the public domain.

- Community Feedback: When the project is ready for release to the public, a mixed community of founders, investors and clients can come together and make a final update to the project.

- Whitepaper Publication: The relevant business whitepaper for the project can now be finally published.

- Productivity Reviews: Treating a business whitepaper as a product can be an effective approach towards enhancing its value in the area it was made for. Honest public product reviews make sure, the project is at par with everyone's interests and always future ready.

A community powered open model will always have the smoothest operations. The last step in the cycle is truly achievable only with an Open Source model. It is the greatest deciding factor in terms of the evolution of how we empower any business model to become self-sustainable.

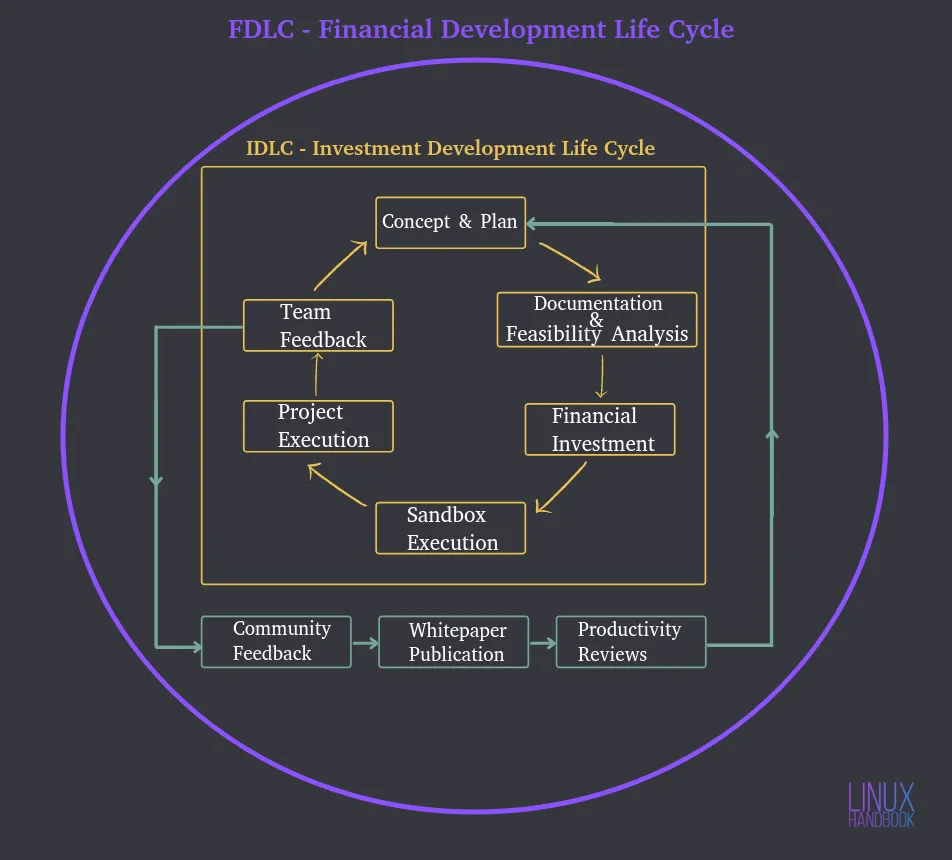

The FinOps Triangle

Similar to the DevOps approach, it is very obvious that FinOps is short for "Financial Operations" and efficiently speeds up the delivery & distribution of currency, steadily and effectively.

The FinOps Triangle requires a consistent balance amongst founders, investors and community. Like SDLC, that needs to pivoted to develop an application, IDLC needs to be community focused and therefore mostly pivoted towards the community. This makes sure the growth of the project is most effective when team skill sets would actually be applied in the continuous enhancement of the project for the entire community.

One must understand that founders and investors are also a part of a community! Therefore, a community focused FDLC model is a win-win for all! Profits are not always in currency. Time and data is also the new money! HumanOps amalgamates this all.

FinTech, or Financial Technology, focuses on decentralized finance…and FinOps can play an invaluable role in transitioning from any centralized model towards a decentralized way of thinking. True decentralization is only possible with quality HumanOps and an Open Source ideology.

If you are an entrepreneur, I hope my thoughts reach you and this model is adopted more and more in various segments in our industry.

If you are not an entrepreneur, I hope this article inspires you in undertaking your own projects and executing them step by step someday!

All the best and thank you for reading until here. I will talk about my perspectives on DevSecOps in the next chapter. Adios till then :) !

DevOps Geek at Linux Handbook | Doctoral Researcher on GPU-based Bioinformatics & author of 'Hands-On GPU Computing with Python' | Strong Believer in the role of Linux & Decentralization in Science